Papua New Guinea Following Zimbabwe?

A Prime Minister who seems to operate without checks and balances, combined with reckless spending and mounting government deficits, accelerates concerns of an economy starting to go out of control.

By Adam Garens

Papua New Guinea may not officially be a one party state, nor its head of state a dictator, but disturbing trends are resulting in some of its people comparing the developing financial situation to that of Robert Mugabe’s Zimbabwe, which by the late 2000’s had experienced the worst hyperinflation in the history of the world.

Zimbabwe’s recent bout of hyperinflation set a record.

While the actual PNG budget deficit blowout is mild by many standards, the apparent inability of any government institution to hold Prime Minister Peter O’Neill accountable for his actions is causing the growing concern. As one Port Moresby resident puts it, “he seems to be spending money on everything but how is he paying the bills?”

PNG Prime Minister Peter O’Neill

PNG Prime Minister Peter O’Neill

The massive ExxonMobil operated LNG project in the country’s Southern Highlands Province was supposed to provide the answer. However, the government began increasing spending dramatically on the promise of LNG receipts alone. Significant revenue is not expected to enter government coffers until 2016 but the Prime Minister mortgaged more than USD $1 billion of the LNG’s initial receipts on a controversial loan to buy government shares in a major PNG petroleum developer, Oil Search, which has now put Mr O’Neill in hot water and possibly prosecution under national anti-corruption laws. Adding further to the woes are a dramatic drop in profits from one of the country’s largest mines which usually provides significant support to the government budget. Overall income from agriculture and non-renewable resources is down and the trend is expected to persist well into next year if not beyond.

Zimbabwean’s were billionaires, but their money barely paid for food.

Zimbabwean’s were billionaires, but their money barely paid for food.

The fear that spending is out of control is magnified by the Prime Minister’s own belief that the PNG people will vote for any candidate who shows action and can quickly put up infrastructure, following decades of slow economic growth. A USD $2 billion loan from the Chinese government’s Exxim Bank was secured for road development primarily, but there are complaints that large sums are leaking out in the form of inflated construction costs and kickbacks. PNG will host the regional Pacific Games next year and additional monies are being poured into the construction of major new sports facilities.

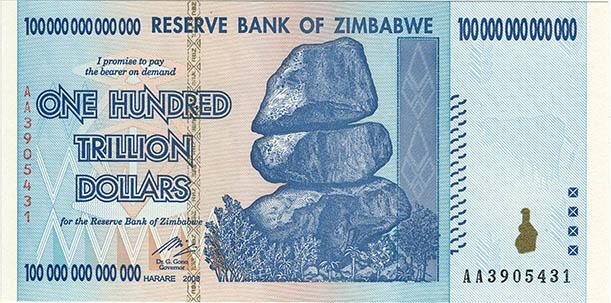

Zimbabwe’s highest denomination money, the one hundred trillion dollar note, was equivalent to about US $300 when issued and now worth about USD $5.

Zimbabwe’s highest denomination money, the one hundred trillion dollar note, was equivalent to about US $300 when issued and now worth about USD $5.

The government has racked up a total national debt of nearly USD $4 billion, with this year’s blowout estimated at about USD $1 billion on an original budget of a little over USD $4 billion. The Bank of PNG was able to sell less than USD $350,000 worth of debt bonds to private investors last month, giving the bank little recourse but to essentially print money through cheap loans from the central bank. Government inflation projections for 2015 have increased from 6% to 8% in only 2 months and there is no longer hope that private sector economic growth will fill in the gap and create reasonable job growth.

None of this at first glance seems to indicate any likelihood of hyperinflation. However Prime Minister O’Neill’s tendency towards making decisions outside of government regulations, his strong commitment to building new infrastructure as rapidly as possible, and his history of deficit spending collectively are causing concern throughout PNG including the private sector. Compounding the situation is a nearly non-existent political opposition with a parliament in nearly complete control of the ruling Peoples National Congress party.

The Zimbabwean dollar was far more worthless than toilet paper but the type of paper used tended to plug up toilets.

The Zimbabwean dollar was far more worthless than toilet paper but the type of paper used tended to plug up toilets.

Hyperinflation, while unknown to now in PNG, has occurred sporadically throughout the world. Prior to the collapse of the Zimbabwe dollar, there was similar hyperinflation in Serbia and before that in Argentina. The most famous historic occurrence of hyperinflation occurred in Weimar Germany in the years following World War I.

By Adam Garens

Papua New Guinea may not officially be a one party state, nor its head of state a dictator, but disturbing trends are resulting in some of its people comparing the developing financial situation to that of Robert Mugabe’s Zimbabwe, which by the late 2000’s had experienced the worst hyperinflation in the history of the world.

Zimbabwe’s recent bout of hyperinflation set a record.

While the actual PNG budget deficit blowout is mild by many standards, the apparent inability of any government institution to hold Prime Minister Peter O’Neill accountable for his actions is causing the growing concern. As one Port Moresby resident puts it, “he seems to be spending money on everything but how is he paying the bills?”

The massive ExxonMobil operated LNG project in the country’s Southern Highlands Province was supposed to provide the answer. However, the government began increasing spending dramatically on the promise of LNG receipts alone. Significant revenue is not expected to enter government coffers until 2016 but the Prime Minister mortgaged more than USD $1 billion of the LNG’s initial receipts on a controversial loan to buy government shares in a major PNG petroleum developer, Oil Search, which has now put Mr O’Neill in hot water and possibly prosecution under national anti-corruption laws. Adding further to the woes are a dramatic drop in profits from one of the country’s largest mines which usually provides significant support to the government budget. Overall income from agriculture and non-renewable resources is down and the trend is expected to persist well into next year if not beyond.

The fear that spending is out of control is magnified by the Prime Minister’s own belief that the PNG people will vote for any candidate who shows action and can quickly put up infrastructure, following decades of slow economic growth. A USD $2 billion loan from the Chinese government’s Exxim Bank was secured for road development primarily, but there are complaints that large sums are leaking out in the form of inflated construction costs and kickbacks. PNG will host the regional Pacific Games next year and additional monies are being poured into the construction of major new sports facilities.

The government has racked up a total national debt of nearly USD $4 billion, with this year’s blowout estimated at about USD $1 billion on an original budget of a little over USD $4 billion. The Bank of PNG was able to sell less than USD $350,000 worth of debt bonds to private investors last month, giving the bank little recourse but to essentially print money through cheap loans from the central bank. Government inflation projections for 2015 have increased from 6% to 8% in only 2 months and there is no longer hope that private sector economic growth will fill in the gap and create reasonable job growth.

None of this at first glance seems to indicate any likelihood of hyperinflation. However Prime Minister O’Neill’s tendency towards making decisions outside of government regulations, his strong commitment to building new infrastructure as rapidly as possible, and his history of deficit spending collectively are causing concern throughout PNG including the private sector. Compounding the situation is a nearly non-existent political opposition with a parliament in nearly complete control of the ruling Peoples National Congress party.

Hyperinflation, while unknown to now in PNG, has occurred sporadically throughout the world. Prior to the collapse of the Zimbabwe dollar, there was similar hyperinflation in Serbia and before that in Argentina. The most famous historic occurrence of hyperinflation occurred in Weimar Germany in the years following World War I.