Why every student must be worried about the state of #PNG’s economy

By MARTIN NAMORONG NAMORONG REPORT

As the Roman empire declined, the ruling elite in ancient Rome held more and more spectacular events to try to distract the masses and stem the inevitable fall of Rome. History has relegated that once mighty empire that ruled for centuries into a museum artefact.

2015 is indeed the year of one of the greatest gladiatorial events in PNG – the South Pacific Games. The Games come at a time when the ruling elite realize they squandered the gains from the oil, mining and LNG boom.

Following over a decade of unprecedented economic growth, our national debt stands between K14 billion and K17 billion depending on whom you want to believe. One may ask, what happened to all the gains of economic growth?

It is important for young Papua New Guineans who are aspirational about getting that dream job and buying a house and car - that such a dream job remains a dream. The reason for this is that the fruits of economic prosperity have been sucked up by a parasitic and predatory elite and very little has been trickling down to the masses. Trickle-down economics hasn’t worked in PNG, as highlighted by the recent PNG Human Development Report.

I would like to encourage students who are entering university and colleges at this time, to talk to your uncles and aunties or friends and acquaintances who went to tertiary institutions in the 1990s. There were no jobs despite the fact that PNG had experienced similar levels of economic growth in the early 1990s as it does now. When Lihir, Porgera and Kutubu projects came on stream, the nation’s Gross Domestic Product (GDP) shot up much the same as it will this year.

But the same mistakes that the previous governments made in the 1990s are being repeated by the current government. Dr Charles Yala and fellow researchers from the National Research Institute warned about this when they criticised the government over the controversial K3 Billion UBS Loan.

“History may repeat itself again given our experience of the early 1990s, as such spending behaviour by the Executive Government created the country’s financial crisis of the 1990s. Expected revenues from the Porgera, Kutubu, Misima and Lihir mines, which were forward spent in an expansionary fiscal policy framework, dried up the coffers of the government, which triggered the financial crisis. This crisis had a significant dent on public finances, and crippled the national economy, having a serious negative impact on the welfare of the PNG people. The trigger for this crisis was the delayed flow in revenue from the three mines and Kutubu, lower revenues than projected and blown up costs of expansionary expenditure projects.”

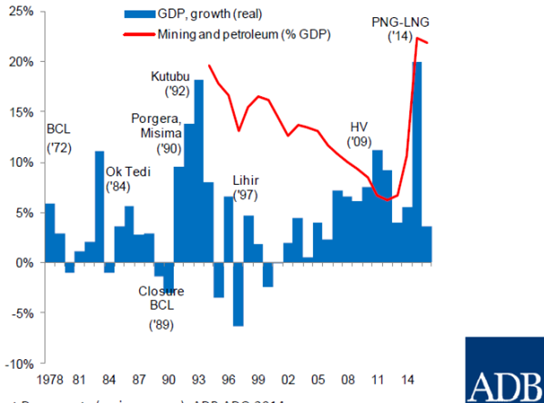

What the NRI Researchers are referring to is demonstrated in the chart above.

Between 1990 and 1993, PNG’s GDP grew by over 10 per cent. When Kutubu came online in 1993, the economy grew at around the same rate as it will this year. Some of you kids at uni were probably babies then. In your life time again, history is repeating itself with gas from the same region as Kutubu fuelling a 15 percent GDP growth in 2015.

Notice however, what happened after the spike of 1993. It was a downward spiral after that and Dr Charles Yala and his colleagues from the NRI reckon that this was because the government had borrowed on future earnings aka the Cayman Island scam of the 1990s.

Students who graduated in the 1990s will recall how tough it was to get a job in those days.

One way of looking at what will happen in the future is to look at current sources of economic growth this (see graph below). This year’s GDP growth is fuelled by the spike in LNG Production. The question arises – what happens after this spike. Where will new sources of growth come from to provide the jobs needed by those of you who are still in school?

Now take a look at the resource revenue projections in the graph below. The green graph indicates revenue from mining while the orange graph shows LNG Revenue.

Notice that the mining boom peaked in 2006 and rallied in 2011 before declining. If you look at the orange LNG graph, what it merely does is fill the revenue gap caused by the decline in mining from Ok Tedi, Porgera and Lihir.

So in reality, there is no golden LNG period ahead where this country will be flush with cash. LNG revenues will merely be plugging the holes from the decline in mining revenues from the current aging mines. New mines take decades to develop so given the current downturn in mineral prices no one is investing in developing new mines.

So in reality, there is no golden LNG period ahead where this country will be flush with cash. LNG revenues will merely be plugging the holes from the decline in mining revenues from the current aging mines. New mines take decades to develop so given the current downturn in mineral prices no one is investing in developing new mines.

You may say mining doesn’t affect other sectors of the economy but it does. If you take a look at the data below, mining does have an impact on other sectors of the economy through procurement of goods and services from suppliers in PNG (worth around K1.56 billion between 2009-11).

The LNG revenue projections shown above in previous graph has already been spent by this government and will be collected by the loan sharks (Banks) much like what happened in the 1990s.

Given this scenario, where is government debt headed. The International Monetary Fund (IMF) has projected that debt is expected to rise up to 50 percent of GDP at current rates of borrowing (See red line on graph below)

What do all these information mean for jobs? If we look at current trends, there has been a jobs decline in the mining sector and the rest of the economy seems to be hovering near zero growth. Jobs in the mining sector declined by 8.1 percent in the June quarter of 2014 whilst the non-mining sector saw job growth at 1.9 percent for the same period.

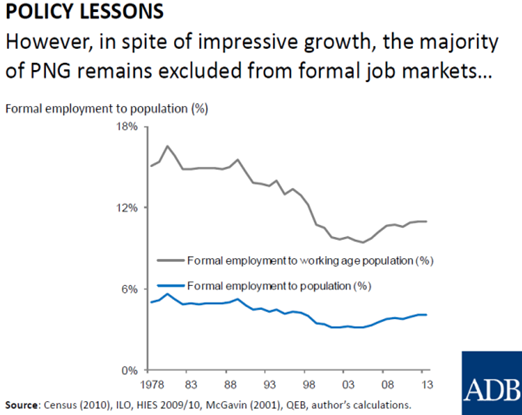

Mistakes that were made in the early 1990s resulted in the lack of jobs for students who graduated from tertiary institutions in the years that followed. The same policy mistakes are being repeated. The impact of poor economic management as the Asian Development Bank’s Country Economist concluded, is that majority of Papua New Guineans remain excluded from the job market despite decades of impressive economic growth.

Please follow Martin on his Blog