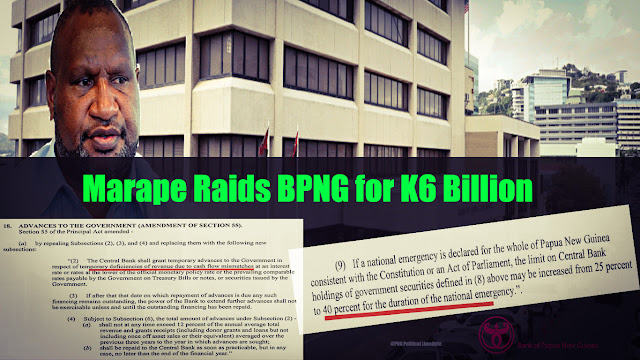

PLES PIG IN THE PIGGY BANK, PM RAIDS CENTRAL BANK

by Andrew Arthur Amendments to the Central Banking Act facilitate Marape and Ling-Stuckey drawing down K6 BILLION from the Bank of PNG to fund the 2022 Budget deficit. Before the amendments, Section 55 of the Central Bank 2000 Act gave provision for the Central Bank to provide Temporary Advances (TAF) to Government for up to K100 million. Section 55(9) clearly states that this TAF should not be used to fund a Budget deficit of the National Government. The IAG recommended that the TAF limit and purpose be retained. https://pngcentralbankactiag.org/report/... The advice of the IAG was just window dressing and was largely ignored and instead, Treasurer and his two advisers Misty Baloiloi & Paul Flanagan have made wholesale changes to Section 55. The amendments to the Central Bank Act allow for Temporary Advances to fund the shortfall of Government revenue paving the way to print money to fund the K6 billion budget deficit. They have changed section 55 to increase the previous K100m