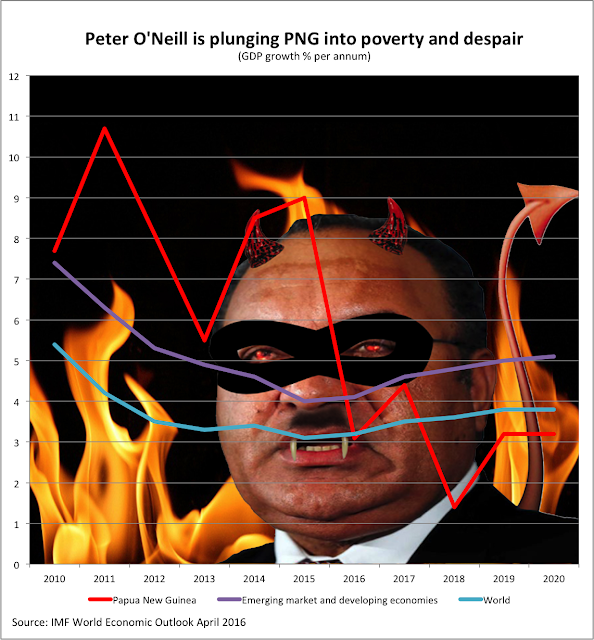

GOVERNMENT’S CREDIBILITY WITH INVESTORS AT ROCK BOTTOM: INEPT FINANCIAL MANAGEMENT BY O’NEILL, PRUAITCH AND MARAPE PREDICTS LOOMING ECONOMIC DISASTER

by WILSON TALAG “For a small country whose economy is heavily dependent on volatile commodity prices to borrow heavily hoping that commodity prices will remain high is the pinnacle of stupidity.” Smart investors are not anywhere as dumb as the average Papua New Guinean citizen whenever Prime Minister Peter O’Neill speaks. O’Neill can utter complete lies about the PNG economy and government budget to the public and people will take his words at face value. Foreign investors and the foreign owned private sector in PNG make good money because they are not so gullible. They check things out and what they have learnt is disturbing. The Prime Minister himself does not understand this reality and continues to present only information he wants the investors to hear. But the investors are wise to his tricks and overall investor confidence in PNG has plummeted close to nil if the side comments of investors are to be taken at face value. Papua New Guinea’s Prime Minist