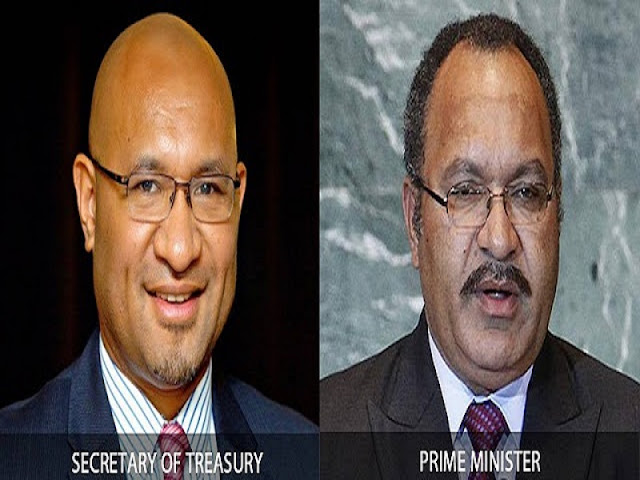

INTERNATIONAL BONDS MARKETS AND BANKS DON'T TRUST O'NEILL LIES AFTER SOVEREIGN BOND FAILURE

by MICHAEL JOSEPH PASSINGAN On 17 March PNG Blogs revealed that Peter O’Neill has secretly begged the World Bank for a loan of up to K1 billion. On 22 March we revealed that international agencies are about to downgrade Papua New Guinea’s credit rating once again – after already being downgraded late last year. Now some good news – the economy and national finances have been damaged so badly by O’Neill’s reckless borrowing and wasteful spending that his proposed $US1 billion sovereign bond issue is dead - D.E.A.D. This is good news because it means the nation’s indebtedness will not increase by $US1 billion in the immediate future. It means the long-suffering people will not have more debt to repay each year. IT MEANS THERE WON’T BE $US1 BILLION FOR O’NEILL TO STEAL AND WASTE The failure of the bond issue proves that international money markets won’t lend a toea to O’Neill’s corrupt regime unless it is at unaffordable penalty interest rates. Such unaffordable interest