FRIGHTENING GOVERNMENT PERFORMANCE IN 8 KEY AREAS OF THE ECONOMY

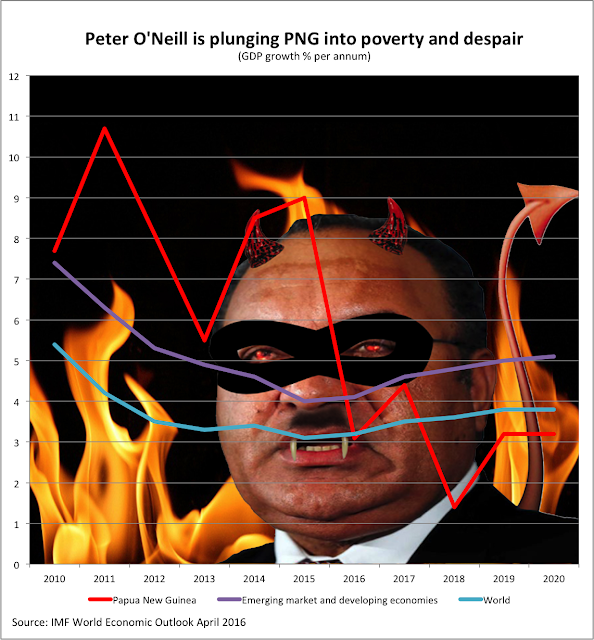

NATIONAL BUDGET SPOOKS PRIVATE BUSINESS AND INVESTMENT IN PNG by WILSON TALAG Economist Paul Flanagan's recent remarks that appeared in PNG Blogs and elsewhere highlight 8 key areas of what looks to be looming financial disaster. Mr Flanagan's enlightening report is the basis for this discussion and why the performance of each one of the key areas has started to spook business and investors. The seriousness of PNG’s current financial situation is becoming very clear. A little over a week ago the government came very close to failing to come up with the year end public servant pay. This near disaster occurred despite supplementary budgets designed to avoid such unexpected money shortages. Another red flag flying high and warning that behind the scenes, PNG's finances are rapidly deteriorating under the O'Neill government. The 8 key areas of concern are (1) Government lies over the actual size and growth of the PNG economy, (2) Discrepancies ove